Mastering Tax Management for Freelance Review Writers

Doing taxes can feel like a puzzle for freelance review writers. Many aren’t sure how to report their income or what they can write off. This blog untangles the tax web, giving you clear steps to manage your freelance finances with confidence.

Dive in for stress-free tax season tips!

Key Takeaways

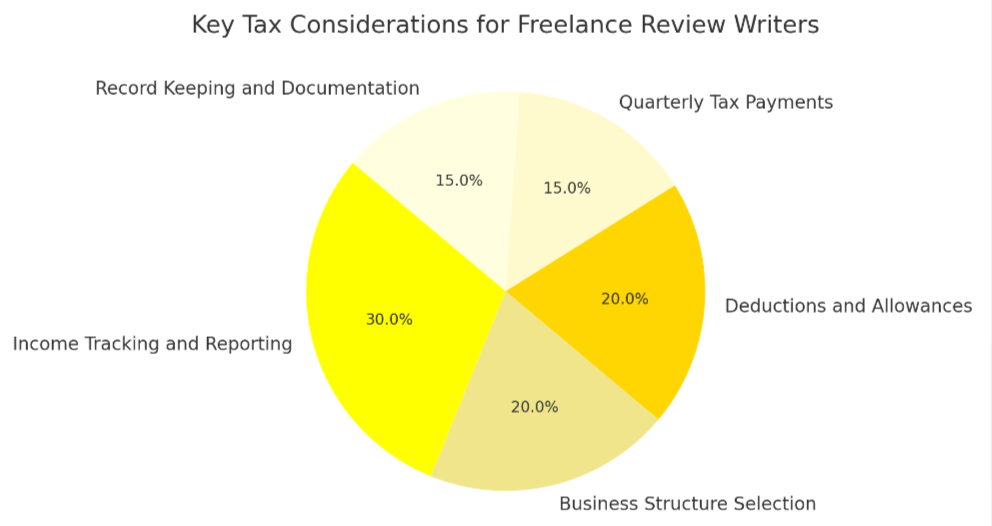

- Freelance review writers must track all income, including cash and digital payments, to accurately report earnings and calculate taxes due.

- Selecting the right business structure, like a sole proprietorship or LLC, can affect tax payments and personal liability; it is crucial to choose the one that aligns with your freelance goals.

- Self-employed writers need to pay self-employment tax if they earn over $400 a year, which includes both Social Security and Medicare contributions at around 15.3% of net earnings.

- Deductions are vital for lowering taxable income; common ones include home office expenses, professional development costs, equipment purchases, health insurance premiums, and work-related travel expenses.

- Quarterly estimated tax payments help avoid penalties from the IRS for underpayment; freelancers should regularly set money aside for these taxes based on their estimated quarterly income.

Understanding Freelance Taxes

Understanding your freelance income and choosing the right business structure are essential for managing taxes. Keeping meticulous records and knowing about self-employment tax can help you take advantage of deductions as a freelance writer.

Knowing your income

Keeping track of every dollar you make is the first step for freelance review writers during tax season. Whether it’s a big project or a smaller gig, recording your total income helps determine how much tax you owe.

Use spreadsheets or accounting software to log payments as they come in. This way, you’ll stay on top of your finances and avoid surprises when it’s time to file.

Make sure to include all sources of freelance income, even if some clients don’t send a 1099 form. Count cash payments, PayPal transfers, and any other forms of compensation for your writing services.

Accurate income reporting ensures you pay the correct amount of taxes and keeps your financial records straight. Next up: choosing the best business structure that suits your freelance endeavors.

Choosing the right business structure

Once you have a clear understanding of your income as a freelance review writer, it’s essential to select an appropriate business structure. Your choice impacts how much tax you’ll pay and the paperwork required.

Many freelancers opt for a sole proprietorship due to its simplicity—you report your writing income on Schedule C and attach it to your personal tax return. However, forming an LLC (Limited Liability Company) can provide extra protection for your personal assets against business-related lawsuits.

Before settling on a sole proprietorship or an LLC, consider the future of your freelance career. If you plan to expand or bring in partners, different structures like partnerships or S corporations could be beneficial.

Each has unique tax considerations and implications for self-employment taxes that must align with your financial goals and tolerance for administrative tasks. Research thoroughly or consult with a professional so that the structure you choose serves both your current needs and long-term aspirations as a successful freelance review writer.

Importance of record-keeping

Good record-keeping is crucial for freelance review writers, especially when tax season rolls around. Keeping track of income and expenses throughout the year makes it easier to file accurate returns and avoid overpaying on taxes.

Organized records can also save you if the IRS ever questions your filings.

Maintaining detailed logs of freelance income, invoices sent, payments received, and receipts for all business-related purchases ensures that nothing slips through the cracks. This practice helps in pinpointing all possible tax deductions for freelance writing expenses and streamlines the process of paying self-employment taxes.

Equally important is understanding how these financial details affect your self-employment tax obligations as we move to discussing this next.

Self-employment tax

Self-employment tax affects freelance writers who are responsible for paying both the employee and employer portions of Social Security and Medicare taxes. Freelancers need to be aware that they must pay self-employment tax if their net earnings from self-employment exceed $400 in a year.

This tax is typically around 15.3% of your net earnings, so it’s crucial to factor this into financial planning and budgeting.

When filing taxes, freelancers can use Schedule SE (Form 1040) to calculate the amount of self-employment tax owed. It’s essential for independent writers to stay organized with income and expense records since these will directly impact their self-employment tax liability.

Deductions for freelance writers

As a freelance writer, you can take advantage of various deductions to lower your tax liability. Here are some key deductions to consider:

- Home office expenses: You may be able to deduct a portion of your rent or mortgage, utilities, and internet costs if you work from home.

- Professional development: Expenses related to courses, workshops, or conferences that enhance your writing skills can be deducted.

- Equipment and supplies: Costs for computers, software, printers, stationery, and other necessary supplies can be deducted.

- Health insurance premiums: If you pay for your own health insurance, these premiums may be deductible.

- Travel expenses: Deductible travel costs include mileage or public transportation used for work-related trips.

Estimating and Paying Quarterly Taxes

Understanding your quarterly tax obligations as a freelance writer is crucial to avoiding penalties and interest on underpaid taxes. By estimating and paying your quarterly taxes, you can stay on top of your financial responsibilities and avoid any surprises come tax season.

Grasping quarterly tax obligations

To grasp quarterly tax obligations, freelance review writers must estimate their income for each quarter and calculate the estimated taxes owed. Keeping track of your income throughout the year will help you determine whether you are required to make quarterly tax payments.

It’s essential to understand that failure to pay sufficient taxes on a quarterly basis may result in penalties from the IRS. Therefore, it’s crucial to stay organized and plan ahead for these periodic tax payments.

Understanding freelance income fluctuations is key to estimating and paying quarterly taxes accurately. This ensures compliance with tax laws and prevents any financial setbacks due to penalties or interest on underpaid taxes.

Strategies for tax planning

After grasping quarterly tax obligations, freelance review writers can implement the following strategies for effective tax planning to optimize their financial situation:

- Keep thorough records of income and expenses to accurately track taxable income and identify potential deductions.

- Set aside a portion of earnings regularly to cover estimated taxes, avoiding last – minute financial strain at tax time.

- Utilize retirement accounts or investment options suitable for self – employed individuals to minimize taxable income while saving for the future.

- Consider consulting with a tax professional to identify additional deductions and ensure compliance with all relevant tax laws.

- Stay informed about changes in tax regulations and incorporate adjustments into long – term financial planning to adapt proactively to new requirements or benefits.

- Maximize available deductions by keeping abreast of eligible expenses such as home office costs, professional development, and necessary equipment for freelance writing activities.

Complying with Tax Laws

Staying compliant with tax laws is crucial for freelance review writers to avoid any potential legal issues. Hiring a tax professional can help navigate the complexities of tax regulations and ensure that all requirements are met.

Staying compliant with tax laws

Freelance review writers must stay compliant with tax laws by accurately reporting their income and availing themselves of eligible deductions. Keep detailed records of your income and expenses to ensure accurate reporting.

Monitor changes in tax regulations that may impact freelance writers, so you can adjust your financial strategy accordingly. Hiring a qualified tax professional is crucial for ensuring compliance and making the most of available deductions.

Looking ahead, it’s essential to proactively adapt to any future changes in tax laws that may affect freelance review writers.

Hiring a tax professional

When considering hiring a tax professional, seek someone with expertise in freelance taxes. Look for professionals experienced with self-employment taxes and familiar with deductions common to freelance writers.

A skilled tax advisor can help maximize your deductions, navigate quarterly tax filings, and provide valuable guidance on record-keeping.

Consider seeking a tax professional who not only helps you comply with current tax laws but also provides insights into future-proofing your freelance finances. They can offer assistance in retirement planning tailored to the unique financial needs of freelancers, as well as keep you informed about any changes in tax regulations that may impact your income as an independent writer.

Future-Proofing Your Freelance Finances

Plan for your future by setting aside a portion of your freelance income for retirement and staying informed about changes in tax regulations that could affect your finances. Adapting to these changes will help ensure the longevity and stability of your freelance career.

Retirement planning for freelancers

Freelancers should prioritize retirement planning to secure their financial future. Here are some essential steps to consider:

- Open a tax – advantaged retirement account such as a SEP IRA or Solo 401(k) to save for retirement.

- Contribute regularly to these accounts to build a substantial nest egg for the future.

- Research and explore investment options that align with your risk tolerance and long – term goals.

- Consider consulting with a financial advisor specializing in self – employed individuals for personalized retirement planning advice.

Adapting to changes in tax regulations

Staying updated with evolving tax regulations is crucial for freelance writers. Changes in tax laws can impact deductions, credits, and reporting requirements. To remain compliant and optimize finances, freelance writers must stay informed about any alterations in tax rules and regulations.

Adapting to changes in tax regulations also involves understanding how new laws may affect quarterly payments or annual filings. It’s essential to be proactive in seeking out resources or professional assistance that can help navigate these changes effectively, ensuring compliance and maximizing deductions within the shifting landscape of tax regulations.

Conclusion

In conclusion, understanding freelance taxes is crucial for review writers. Freelancers need to estimate and pay quarterly taxes to stay on top of their tax obligations. Complying with tax laws and planning for the future are essential in securing their financial stability.

Therefore, freelance review writers should leverage these considerations for a successful and sustainable career.