Creating Financial Security in the World of Review Writing

As a review writer, you may face unpredictable income streams. Did you know most financial experts recommend an emergency fund to cover three to six months of expenses? This blog will guide you through the steps to create a safety net that keeps your finances secure while you focus on writing great reviews.

Let’s build that cushion together!

Key Takeaways

- Start by setting clear financial goals, like saving three to six months of living expenses for emergencies. Open a dedicated savings account specifically for this purpose.

- Create a monthly budget and set up automatic transfers to your emergency fund. Use any extra income, like tax refunds or bonuses, to help build your savings faster.

- Avoid dipping into your emergency fund for non – emergencies. Set strict criteria for its use, replenish it quickly after withdrawal, and continue contributing regularly.

- Balance building an emergency fund with other financial goals such as retirement saving and debt repayment. Adjust your budgeting so you can work towards all goals simultaneously.

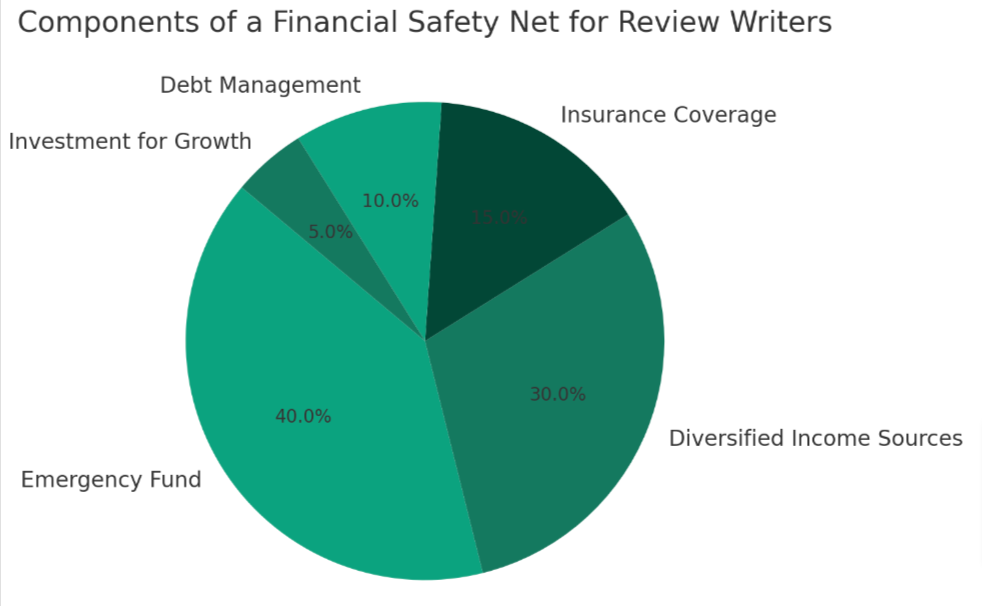

- Combine having an emergency fund with insurance coverage to create a comprehensive financial safety net that helps maintain long-term stability and promotes peace of mind.

Understanding the Importance of Emergency Savings

An emergency fund plays a critical role in providing financial security during unexpected situations. Real-life scenarios demonstrate the necessity of having this safety net in place for peace of mind and stability.

The role of an emergency fund

Having an emergency fund is like having a financial fire extinguisher—ready at a moment’s notice to smother unexpected expenses. Life tosses curveballs, such as sudden medical bills, car repairs, or job loss, and without a safety net, these events can wreak havoc on your finances.

An emergency fund acts as a buffer that keeps you from falling into debt when the unforeseen strikes.

By setting aside money in a dedicated savings account for emergencies only, you create financial security for yourself and your family. Think of it as insurance against life’s unpredictable moments; this monetary cushion reduces stress and gives you peace of mind knowing that should trouble come knocking, you’re financially equipped to handle it head-on.

This proactive approach to personal finance ensures business resilience by providing income protection when regular sources may falter or pause altogether.

Real-life scenarios of the necessity of emergency funds

Imagine your car breaks down unexpectedly, and the repair costs are steep. Without an emergency fund, you could be stranded or forced to use high-interest credit cards that further strain your finances.

An emergency cushion gives you the power to pay for these repairs outright, ensuring transportation is available when needed and keeping debt at bay.

A medical emergency can hit anyone at any time. If you suddenly need to cover a hefty deductible or out-of-pocket medical expenses, having money set aside ensures that health emergencies don’t turn into financial catastrophes.

This safety net supports peace of mind during tough times and allows focus on recovery rather than monetary stress. Now let’s explore strategies for actually building that all-important emergency savings account.

Strategies for Building Emergency Savings

Implement practical first steps, such as creating a budget and automating savings. Consider different income streams and windfalls to bolster your emergency fund.

Practical first steps

Starting to build a financial safety net can feel daunting, but as a review writer, it’s crucial to take control of your finances. Consider these practical first steps to establish a solid foundation for your emergency savings.

- Set clear goals: Define how much you want to save for emergencies by calculating three to six months of living expenses.

- Open a dedicated savings account: Keep your emergency fund separate from your regular checking account to avoid the temptation of dipping into it.

- Assess your monthly income and expenses: Create a detailed budget that tracks all your spending and identifies areas where you can cut back.

- Prioritize saving: Treat your emergency fund contributions like any other essential bill that must be paid each month.

- Start small if necessary: If large contributions are not feasible, begin by saving smaller amounts regularly; consistency is key.

- Increase savings over time: Boost your contributions gradually as you reduce expenses or earn more from reviewing projects or side jobs.

- Automate transfers: Use automatic transfers to move money into your emergency fund without having to think about it.

- Review progress often: Check in on your savings at least quarterly and adjust your strategies to stay on track with your goals.

Budgeting and automating savings

To build an emergency fund and financial safety net, budgeting and automating savings are crucial steps. Here’s how to effectively implement them:

- Create a monthly budget that includes a specific amount for emergency savings.

- Set up automatic transfers from your checking account to a separate savings account each month.

- Use budgeting tools or apps to track your expenses and identify areas where you can cut unnecessary spending.

- Consider allocating windfalls, such as tax refunds or bonuses, directly into your emergency fund.

- Regularly review and adjust your budget to ensure that you’re consistently saving for emergencies.

- Automate bill payments and other regular expenses to free up mental space for focusing on building your emergency fund.

Income streams and windfalls

After establishing a budget and automating savings, it’s essential to consider additional income streams and windfalls as a means of bolstering your financial safety net. In addition to regular employment income, freelance work, side gigs, or passive income from investments can all contribute to boosting your emergency fund.

Windfalls such as tax refunds, bonuses, or unexpected monetary gifts should also be channeled towards building and fortifying your financial cushion. By diversifying income sources and strategically allocating windfalls, you can enhance the resilience of your emergency savings while accelerating progress towards your long-term financial goals.

Building multiple income streams alongside capitalizing on unexpected windfalls can significantly reinforce your ability to weather unforeseen financial challenges while simultaneously advancing your overall financial stability.

Managing and Using Emergency Savings

When it comes to using your emergency fund, it’s important to make thoughtful decisions about when and how to access these savings. Replenishing and avoiding common pitfalls will also be crucial in ensuring that your financial safety net remains intact.

Deciding when to use your fund

When deciding when to use your emergency fund, consider the urgent nature of the expense.

- Assess the urgency: Evaluate if the expense is necessary for your immediate safety or well-being, such as medical emergencies or essential home repairs.

- Weigh alternatives: Consider alternative sources of funding before utilizing your emergency savings, such as reallocating funds from non-essential expenses or seeking assistance from family and friends.

- Evaluate impact: Analyze the potential impact of using your emergency fund on your overall financial stability and future security.

- Replenishment plan: Establish a plan for replenishing the withdrawn amount to ensure that your emergency fund remains adequately funded for future unforeseen events.

- Avoid impulsive decisions: Exercise caution and avoid using the fund for non-urgent or discretionary expenses to maintain its intended purpose as a safety net.

Replenishing and avoiding common pitfalls

To ensure your emergency fund remains robust, it’s crucial to regularly replenish it and steer clear of common pitfalls. Here are some tips to help you maintain and grow your emergency savings:

- Consistently contribute a portion of each paycheck to your emergency fund.

- Avoid using the fund for non – emergencies by establishing clear criteria for when to dip into it.

- Keep an eye on inflation and adjust the amount in your fund accordingly.

- Replenish the fund as soon as possible after using it for a qualified emergency.

- Be cautious about investing your emergency savings in high – risk assets to avoid potential losses.

Balancing with other financial goals

When building your emergency savings, it’s essential to strike a balance with other financial goals. While prioritizing your safety net is crucial, it’s also important to consider long-term objectives such as saving for retirement, investing in assets, and paying off debts.

By budgeting wisely and automating contributions to your emergency fund, you can simultaneously work towards these goals. It’s about finding the right allocation of resources that allows you to build a resilient financial cushion while continuing to make progress in other areas.

Moreover, diversifying your income streams and cutting unnecessary expenses can free up funds for emergency savings without neglecting other financial priorities. This balanced approach not only enhances your overall financial security but positions you on a path toward long-term stability and growth.

The Relationship Between Emergency Funds and Long-Term Financial Planning

Emergency funds play a crucial role in achieving long-term financial goals and providing peace of mind for the future. Want to learn more about how to build and manage your emergency savings? Keep reading!

The psychological benefits

Having an emergency fund can relieve stress and anxiety. It provides a sense of security and peace of mind, knowing that there is a financial cushion to fall back on in case of unexpected events.

This feeling of stability can reduce the mental toll that comes with worrying about potential financial disruptions.

Moreover, having emergency savings can improve overall well-being by reducing feelings of vulnerability during tough times. It helps individuals feel more in control of their finances and able to handle any unexpected expenses that may arise without impacting their long-term financial goals.

Complementary tools: emergency funds and insurance

Emergency funds and insurance serve as complementary tools, working together to provide financial security in times of need. While emergency savings offer immediate access to cash for unexpected expenses, insurance acts as a protective shield against major financial setbacks.

By combining the two, individuals can create a robust safety net that safeguards their financial stability and peace of mind. Whether it’s medical emergencies, car repairs, or job loss, having both emergency funds and insurance ensures that unforeseen circumstances do not derail long-term financial plans.

Understanding the synergy between emergency funds and insurance is crucial for establishing a resilient budget and protecting against unexpected monetary challenges. Emergency savings provide liquidity for short-term needs while insurance offers broader coverage for large-scale events.

The role of emergency funds in achieving financial independence.

Emergency funds play a crucial role in achieving financial independence by providing a safety net during unexpected financial challenges. Establishing an emergency fund not only safeguards your financial stability but also enables you to pursue long-term goals without being derailed by sudden expenses.

This financial cushion allows you to stay afloat during job loss, medical emergencies, or unforeseen home or car repairs, ensuring that you can maintain your lifestyle and avoid accumulating high-interest debt.

By having an emergency fund in place, individuals can confidently navigate their journey towards financial independence. It provides the freedom to invest in opportunities for wealth-building without worrying about how to cover essential expenses during uncertain times.

Conclusion

In conclusion, as a review writer, it is essential to prioritize building a financial safety net. Establishing an emergency fund and managing savings can provide peace of mind in times of uncertainty.

By implementing practical strategies and understanding the relationship between emergency funds and long-term financial planning, you can safeguard your financial security while pursuing your career as a review writer.