Smart Investment Strategies for Review Writers’ Earnings

Are you sitting on a little pile of cash from writing reviews but not sure what to do with it? Believe it or not, even small earnings can grow with smart investing. This blog will show you how to turn those review-writing bucks into a flourishing investment garden.

Keep reading and let’s make your money work for you!

Key Takeaways

- Starting to invest early can significantly boost the growth of earnings from review writing due to the power of compound interest.

- Diversifying investments across different asset classes like stocks, bonds, and real estate helps manage risk and can lead to better returns.

- Keeping track of earnings season is important for making informed decisions about where to allocate investment funds and understanding company performances.

- Living within your means and evaluating monthly income allows for sustainable investing without compromising essential living needs.

- Choosing the right type of investment account depends on individual financial goals, fees, minimum balance requirements, and whether tax advantages are needed.

Understanding the Basics of Investing

Different types of investments are available and it’s important to set clear investing goals, assess risk, and understand your time horizon.

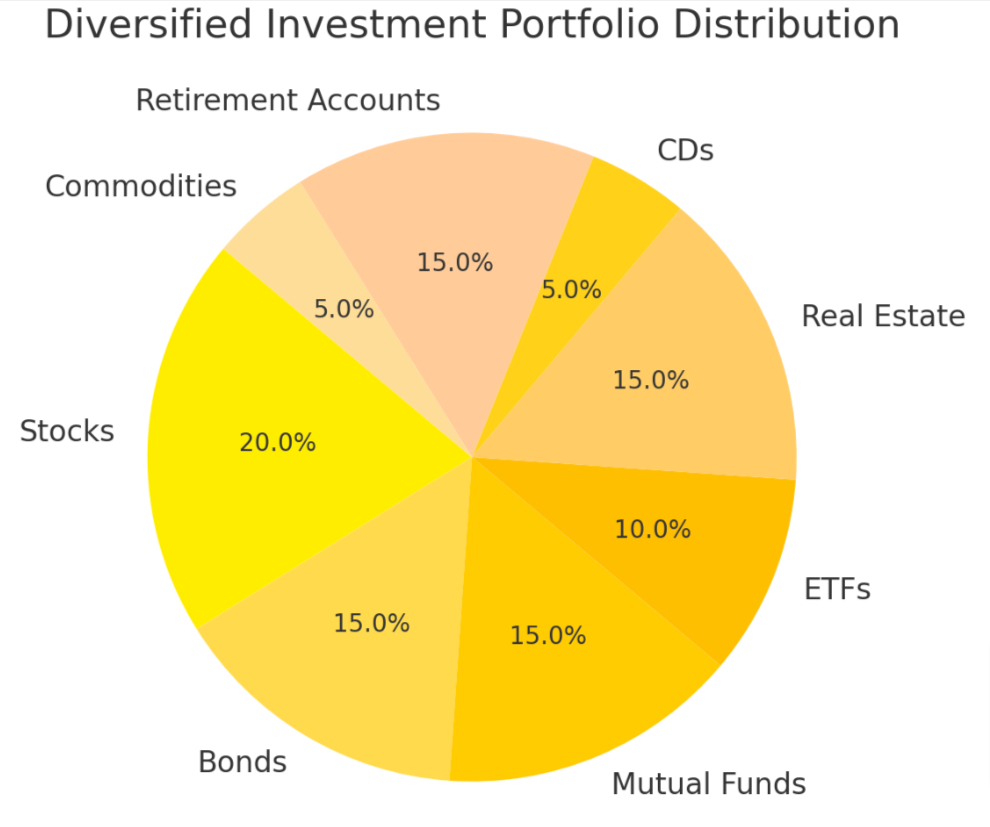

Different Types of Investments

Exploring the world of investing can open up numerous avenues for growing your wealth. From stocks to bonds, each type of investment offers unique benefits.

- Stocks give you a piece of ownership in a company. When its value rises, so does your investment.

- Bonds are loans you make to a government or corporation. In return, they pay you back with interest.

- Mutual funds combine money from many investors to buy various securities. This spreads out the risk.

- Exchange – traded funds, or ETFs, track indexes like the S&P 500. They trade on stock exchanges just like individual stocks.

- Real estate investments involve buying property to earn rental income or sell at a higher price later.

- Certificates of deposit (CDs) are savings accounts with a fixed interest rate and maturity date. Banks offer these for terms ranging from a few months to several years.

- Retirement accounts, such as IRAs and 401(k)s, offer tax advantages for long – term saving.

- Commodities include tangible assets like gold, oil, or agricultural products that you can invest in directly or through futures contracts.

Importance of Setting Investing Goals

Having clear investing goals helps guide your financial journey, much like a roadmap. Whether you’re channeling your earnings from writing reviews into stocks or bonds, knowing what you want to achieve gives your investing purpose and direction.

You might be aiming for retirement savings, an educational fund, or maybe just growing wealth over time. By laying out specific objectives, you can pick the right investments that align with how much cash you’re willing to risk and when you’ll need access to your funds.

Setting these targets also aids in staying focused during market ups and downs. It’s easy to make hasty decisions based on emotions when money is involved; however, with solid goals in place, you can hold steady and remember why you started investing in the first place.

Keep this strategy balanced by assessing risks and understanding your time horizon for investments as we explore next.

Assessing Risk and Time Horizon

Once you’ve outlined your investing goals, it’s time to consider how much risk you’re comfortable taking and when you’ll need the money. Your risk tolerance is like a speed limit for your investment journey — go too fast and you might crash, go too slow and you won’t reach your destination in time.

So think of assessing risk as finding that sweet spot where the potential for growth meets your peace of mind.

Your time horizon plays a big role in this balance act. If retirement or buying a home is decades away, you might lean towards more aggressive investments since there’s ample time to recover from any dips in the market.

But if you plan on using those earnings from writing reviews sooner rather than later, opting for safer bets with lower returns could be the smarter choice to avoid losing capital right before needing it.

Choose wisely — each investment vehicle has its own roadmap and traffic conditions (like volatility), so match them with how long you can keep cruising before hitting your financial destination.

Strategies for Investing Earnings from Review Writing

Get an early start by investing a portion of your earnings regularly, diversify your investments to spread out risk, and keep an eye on earnings season to make informed decisions about where to allocate your funds.

Early Start is Key

Start investing early to maximize the potential growth of your earnings. By beginning early, you allow more time for your investments to grow and compound, increasing your overall returns over the long term.

This strategy also allows you to take advantage of market fluctuations while having time on your side to ride out any short-term downturns.

An early start enables you to harness the power of compounding interest, potentially turning a small initial investment from review writing into a significant sum over time. This could provide financial security and freedom in the future and allow you to achieve your long-term goals through strategic investment planning.

Diversification and Rebalancing

Diversifying your investment portfolio is crucial for managing risk and maximizing returns. By spreading your investments across various asset classes, such as stocks, bonds, and real estate, you can reduce the impact of volatility in any one sector.

Rebalancing involves periodically adjusting your portfolio to maintain the desired level of diversification. It ensures that you stay aligned with your long-term investment objectives and risk tolerance, preventing overexposure to any single type of asset.

Regularly reviewing and adjusting your investments based on market conditions helps to keep your portfolio in line with your financial goals. Diversification and rebalancing are integral components of a sound investment strategy, allowing you to navigate market fluctuations while optimizing potential returns.

Keep an Eye on Earnings Season

After diversifying and rebalancing your investments, it’s crucial to keep an eye on earnings season. When companies release their quarterly financial reports, the stock market can experience significant movements based on these results.

It’s essential for investors to stay informed about these updates as they can provide valuable insights into the performance of individual companies and entire industries. By paying attention to earnings season, you can make more informed decisions regarding your investment portfolio and potentially capitalize on emerging opportunities in the market.

Furthermore, monitoring earnings season allows you to assess the financial health of the companies in which you’ve invested. Whether you’re interested in capital growth or dividend income, understanding how a company is performing financially is pivotal in managing your investment strategy effectively.

How to Invest Wisely and Avoid Financial Fraud

Living within your means, evaluating your monthly income, and choosing the right investment account are essential to avoid financial fraud and invest wisely. To learn more about smart ways to invest your earnings from review writing, keep reading!

Living Within Your Means

To wisely invest earnings from review writing, it’s crucial to live within your means. By evaluating monthly income against expenses, you can identify a feasible investment amount that won’t strain your budget.

This approach allows for sustainable investing without compromising essential living needs. Choosing the right investment account tailored to your financial situation further enhances the ability to live within your means while growing wealth.

Choosing investments and an investment style suited to personal circumstances is fundamental in avoiding financial fraud. Evaluating spending habits and aligning them with income helps mitigate potential risks associated with high-cost activities or unsustainable lifestyle choices.

Evaluating Your Monthly Income

After calculating your monthly income, determine the fixed expenses such as rent or mortgage payments, utilities, and insurance. Then, consider variable expenses like groceries, entertainment, and transportation costs.

This evaluation helps you understand how much money is available for investing after covering essential living expenses.

Identifying discretionary income allows you to allocate a portion towards investments wisely. It’s crucial to maintain a balanced approach by setting aside funds for savings and investment while also ensuring there’s enough left for emergency reserves.

Choosing the Right Investment Account

After evaluating your monthly income, choosing the right investment account is essential for achieving your financial goals. Consider factors such as fees, minimum balance requirements, and available investment options when selecting an account.

Assess whether a traditional brokerage account or a tax-advantaged retirement account like an IRA or 401(k) aligns with your investment objectives and time horizon. Additionally, evaluate the level of customer service and online tools offered by different financial institutions to ensure you have the support needed to manage your investments effectively.

Evaluate various types of accounts based on their suitability for individual needs. Consider commission-free trading platforms if you plan to trade stocks frequently or opt for robo-advisors that offer automated portfolio management at a lower cost.

Resources for Investing

Explore the best brokerage accounts, online stock brokers, and robo-advisors for beginners. Get tips on investing in passively managed funds to help grow your earnings wisely.

Best Brokerage Accounts for Stock Trading

When looking for brokerage accounts for stock trading, consider the following options:

- Vanguard: Known for low-cost index funds and exchange-traded funds, suitable for long-term investors seeking a hands-off approach.

- Charles Schwab: Offers a wide range of investment choices and research tools, ideal for active traders and long-term investors alike.

- Fidelity Investments: Provides a user-friendly platform with zero-commission trades, making it an attractive option for both beginner and experienced investors.

- TD Ameritrade: Offers advanced trading platforms and educational resources, suitable for active traders looking for a comprehensive trading experience.

- E*TRADE: Known for its easy-to-use platform and extensive research offerings, making it a good fit for beginners and seasoned investors looking to trade stocks.

- Merrill Edge: Ideal for Bank of America customers seeking seamless integration between banking and investment activities with access to robust research tools.

- Interactive Brokers: Suited for professional or highly active individual traders due to its sophisticated trading platforms and extensive access to global markets.

- Ally Invest: Offers competitive pricing with no account minimums or hidden fees, providing an affordable option for self-directed investors.

- Robinhood: Known for commission-free trading of stocks, ETFs, options, and cryptocurrencies via a user-friendly mobile app, appealing to cost-conscious and tech-savvy investors.

Best Online Stock Brokers for Beginners

When starting as a beginner investor, choosing the right online stock broker is crucial. Look for brokers that offer low fees, user-friendly platforms, and educational resources to support your learning journey.

- Research and compare different online brokers to find the one that best suits your investment needs.

- Consider factors such as commission fees, account minimums, and the range of investment options available.

- Look for brokers that provide access to research tools, educational materials, and customer support to help you make informed investment decisions.

- Evaluate the usability of the trading platform and mobile app to ensure they are intuitive and easy to navigate.

- Check for additional features like market analysis, real – time quotes, and customizable dashboards that can enhance your trading experience.

Best Robo-Advisors

After considering the best online stock brokers for beginners, exploring the best robo-advisors is essential for those looking to invest earnings from review writing wisely. These automated investment platforms offer a range of features to help investors achieve their financial goals. Here’s a detailed look at some of the top robo-advisors available:

- Wealthfront: Known for its low fees and tax-efficient investment strategies, Wealthfront provides automated portfolio management tailored to individual financial goals.

- Betterment: With personalized advice and diversified investment options, Betterment offers a user-friendly platform ideal for both new and experienced investors.

- Ellevest: Designed specifically with women’s financial needs in mind, Ellevest provides customized investment portfolios based on specific life goals.

- SoFi Invest: Offering commission-free trading and access to experts for personalized advice, SoFi Invest is suitable for both active and passive investors.

- M1 Finance: This platform combines automated investing with customizable portfolio options, allowing users to create their own investment pies based on individual preferences.

- Acorns: Ideal for those who want to start investing with small amounts, Acorns automates savings by rounding up everyday purchases and investing the spare change.

- Charles Schwab Intelligent Portfolios: With no advisory fees or commissions, this robo-advisor offers a wide range of investment options and personalized portfolio management.

- Vanguard Digital Advisor: Providing expertly managed portfolios with low costs, Vanguard’s digital advisor uses advanced algorithms to create custom-tailored investments based on specific needs.

- Fidelity Go: Offering a streamlined investment process with diversified portfolios designed by professionals, Fidelity Go provides automated guidance and monitoring.

- TD Ameritrade Essential Portfolios: Utilizing modern technology and professional insights, TD Ameritrade’s robo-advisor offers diverse investment strategies tailored to individual financial goals.

Tips for Investing in Passively Managed Funds

Passively managed funds, also known as index funds or exchange-traded funds (ETFs), are designed to mirror the performance of a specific market index. Investing in passively managed funds can offer several advantages for individuals looking to grow their wealth steadily over time. Here are some tips for investing in passively managed funds:

- Research and Select Low-Cost Funds: Look for passively managed funds with low expense ratios to ensure that a smaller portion of your investment returns is eaten up by fees.

- Consider Diversification: Choose passively managed funds that provide exposure to a broad range of asset classes, such as stocks, bonds, or real estate, helping spread risk across different segments of the market.

- Monitor the Tracking Error: Assess the fund’s ability to replicate the performance of its target index by keeping an eye on its tracking error over time.

- Stick to Your Investment Plan: Avoid making impulsive decisions based on short-term market fluctuations; maintain a long-term perspective when investing in passively managed funds.

- Rebalance Periodically: Regularly review your investment portfolio and rebalance if necessary to ensure it aligns with your desired asset allocation.

- Embrace Automated Investing: Consider automating contributions to your passively managed funds at regular intervals, utilizing features like dollar-cost averaging to benefit from market fluctuations.

- Stay Informed About Tax Implications: Be aware of potential tax consequences associated with owning passively managed funds, such as capital gains distributions and their implications for your tax liability.

Conclusion

In conclusion, wisely investing earnings from review writing is essential for long-term financial security. Setting clear investment goals and diversifying your portfolio can help mitigate risks.

Keeping an eye on quarterly earnings can inform your investment decisions while avoiding financial fraud is crucial to safeguarding your hard-earned money. By starting early and making informed choices, you can build a strong foundation for financial growth and stability.