Essential Financial Tracking for Success in Review Writing

Struggling to keep track of your money in review writing? Writers often miss out on potential tax savings simply because they’re not meticulous with their finances. This blog post will guide you through the essentials of earnings and expense tracking specifically tailored for reviewers.

Dive in for financial clarity!

Key Takeaways

- Opening a separate business account and using accounting software makes tracking earnings and expenses clearer, providing a snapshot of financial health for review writers.

- Regularly examining business expenses can reveal overspending and help writers make cost – effective decisions that improve their bottom line.

- Proper categorization of expenses using tools like apps or spreadsheets not only simplifies tax preparation but also maximizes potential deductions, saving money during tax season.

- Engaging with financial professionals, such as bookkeepers or advisors, allows review writers to benefit from expert guidance in managing their finances more efficiently.

- By consistently reviewing and analyzing financial reports, review writers can maintain accurate records, aiding in long-term strategic planning for their writing endeavors.

Importance of Tracking Business Expenses

Tracking business expenses is crucial for keeping financial records organized, identifying areas of overspending, and maximizing tax deductions. It helps in managing business finances effectively.

Keeping financial records organized

Keeping financial records organized sets the stage for smarter business decisions and stress-free tax preparation. Start by creating a system that works for you—this might mean using digital tools like financial tracking software or traditional filing methods to keep important documents in order.

Make it a habit to record every transaction, whether it’s income from clients or expenses for supplies. Regular updates to your financial data prevent headaches down the road and allow you to see at a glance where your money is going.

Organizing receipts by category simplifies budgeting and expense tracking, ensuring nothing slips through the cracks. Use clearly labeled folders, whether virtual or physical, so retrieving information during audits or financial reviews becomes a breeze.

A well-ordered finance system not only saves time but helps manage cash flow more effectively. By keeping on top of this crucial task, you maintain control over your business’s purse strings and are better equipped to plot its course towards success.

Identifying areas of overspending

Spotting where your money leaks may seem tricky, but it’s crucial for maintaining a healthy balance sheet. Start by scrutinizing monthly expenses and comparing them against your budget.

Look closely at recurring payments; sometimes, small increments can balloon into significant sums over time. Utility bills, subscription services, and office supplies are common culprits that often get overlooked.

Dive deeper into expense tracking by examining each line item on bank statements and credit card receipts. This helps pinpoint exactly where costs can be reduced or eliminated. Implementing this habit ensures that every dollar spent pushes the business forward instead of draining its resources.

Analyzing business expenditures regularly leads to smarter spending decisions and more efficient financial planning overall.

Maximizing tax deductions

Keep track of every penny spent on business-related activities, because these can add up to significant tax deductions. This means logging mileage for travel, keeping utility bills for the home office, and saving receipts from client meetings.

Not only does this lower your taxable income, but it also paints a clearer financial picture of where your money goes.

To ensure you’re getting all the deductions you’re entitled to, stay current with tax laws or consult a tax professional. Use financial tracking software designed for expense management to simplify this task; many programs will categorize expenses for you and highlight potential deductions.

Remember that every dollar saved in taxes through legitimate deductions is more money in your pocket for growing your business or investing back into your craft as a review writer.

How to Track Business Expenses

Open a separate business account and choose accounting software to easily track expenses. Connect financial institutions, file receipts, categorize expenses, and regularly review and analyze expenses for better financial management.

Open a separate business account

Establish a dedicated business account to separate personal and business finances. This allows for clear tracking of income and expenses, simplifying tax preparation and financial reporting.

Additionally, it helps in maintaining accurate records for audits or when seeking funding or loans. Using a separate account also provides credibility to your business transactions, enhancing trust with clients and partners.

By opening a designated business account, you ensure that personal funds are kept distinct from company assets. This separation streamlines money management by providing a clear picture of the financial health of your business operations.

Choose accounting software

Consider your business needs when selecting accounting software. Look for user-friendly interfaces and essential features such as invoicing, expense tracking, and financial reporting tools.

Ensure that the software integrates with your bank accounts and credit cards to streamline data entry and reconciliation processes. Compare different options in terms of cost, scalability, and customer support to find the best fit for your business.

Additionally, consider cloud-based solutions for accessibility and automatic updates without the hassle of manual installations.

Furthermore, prioritize security features like data encryption and regular backups to safeguard sensitive financial information. Evaluate whether the software supports multi-currency transactions if your business operates internationally or deals with foreign clients.

Connect financial institutions

After choosing accounting software, the next step is to connect your financial institutions for seamless expense tracking. By linking your business accounts with your chosen accounting software, you can automatically import transactions, saving time and reducing the risk of manual errors.

This connection also allows for real-time monitoring of income and expenses, providing a clear picture of your financial standing. With this direct link in place, you can easily categorize expenses and assign them to specific budget categories, enabling more accurate financial reporting and analysis.

By connecting financial institutions to your accounting software, you streamline the process of tracking business expenses and gain valuable insights into your cash flow and spending patterns.

File receipts and categorize expenses

Tracking and categorizing expenses is a crucial aspect of maintaining financial records for your business. It helps in accurately monitoring where your money is going, aiding tax preparations, and analyzing spending patterns. Here are the key steps to effectively file receipts and categorize expenses:

- Collect all receipts and invoices related to business expenses to ensure nothing is overlooked or forgotten.

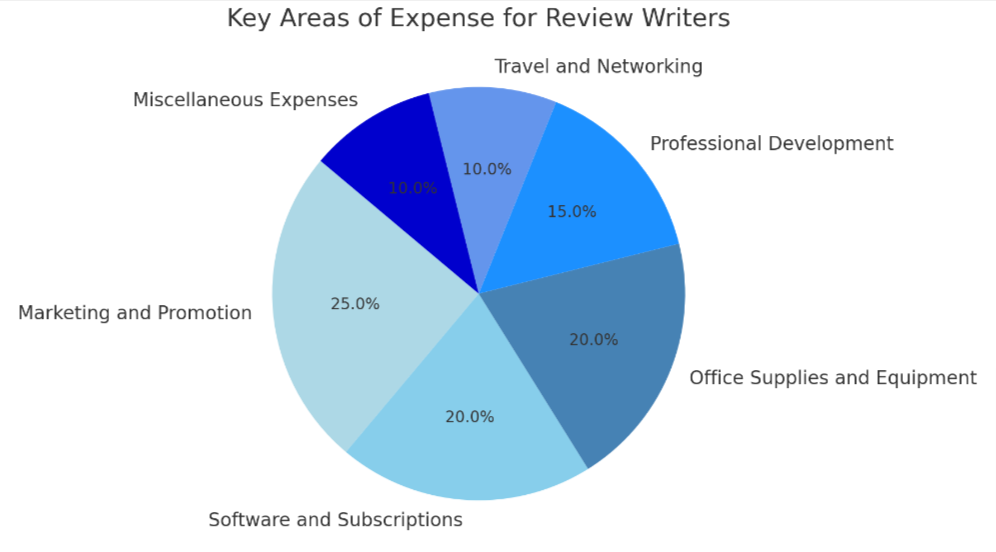

- Categorize expenses into specific categories such as office supplies, travel, utilities, marketing, or professional services.

- Use accounting software or spreadsheets to record each expense under the appropriate category for easy access and analysis.

- Ensure that receipts are stored in a safe and organized manner for future reference and auditing purposes.

- Regularly review and reconcile categorized expenses to identify any discrepancies or potential areas for cost-saving measures.

Regularly review and analyze expenses

Regularly reviewing and analyzing expenses is essential for keeping your business financially healthy. It helps in identifying spending patterns, evaluating the effectiveness of financial strategies, and making informed decisions for the future.

- Identify areas of overspending: By regularly reviewing and analyzing expenses, you can pinpoint where your business is overspending. This allows you to take corrective action and allocate resources more efficiently.

- Track changes in revenue and costs: Keeping a close eye on your income and costs enables you to identify any fluctuations or trends that may impact your business’s financial stability.

- Assess budget adherence: Regular reviews help in evaluating how well you are sticking to your budget plan. This allows for necessary adjustments to ensure financial goals are met.

- Monitor cash flow: By analyzing expenses regularly, you can ensure that there is enough cash available to cover operational needs and plan for future investments.

- Evaluate return on investment (ROI): Analyzing expenses helps in assessing the effectiveness of various business initiatives and determining which ones provide the best returns.

Tips for Effective Expense Tracking

Know your financial knowledge and consider hiring a bookkeeper to help manage your business expenses. Familiarize yourself with tax-deductible expenses to maximize savings.

Know your financial knowledge

Assess your financial knowledge to make informed decisions. Understand basic accounting principles and how they apply to your business. Identify potential areas of improvement by staying updated with tax laws and regulations.

Continuously learn about financial management to maintain strong control over your business finances. Gain the expertise needed for effective budgeting and expense tracking in order to achieve long-term success in managing your company’s funds.

Moving forward, let’s delve into the benefits of hiring a bookkeeper for efficient expense tracking and better financial planning.

Consider hiring a bookkeeper

Consider hiring a bookkeeper to maintain accurate and up-to-date financial records. A professional bookkeeper can help categorize business expenses, keep track of invoices, manage payroll, and ensure compliance with tax regulations.

By delegating these tasks to an expert, you can focus on the core aspects of your business and make informed financial decisions.

Understanding the ins and outs of accounting software or staying updated with changing tax laws may be time-consuming. Hiring a bookkeeper who specializes in small business accounting allows you to leverage their expertise for efficient expense tracking and comprehensive financial reporting, ultimately contributing to better financial management and long-term success.

Familiarize with tax-deductible expenses

After considering hiring a bookkeeper to assist you with managing your business expenses, it’s essential to familiarize yourself with tax-deductible expenses. This involves understanding the types of expenses that can be deducted from your taxable income, such as business-related travel costs, office supplies, and professional fees.

By becoming knowledgeable about these deductible expenses, you can effectively reduce your tax liability and retain more of your hard-earned income.

Identifying all potential tax-deductible expenses requires thorough record-keeping and a clear understanding of IRS guidelines. Leveraging financial tracking software or consulting with a professional can help ensure that you are maximizing your deductions while staying compliant with regulations.

Additional Considerations for Tracking Business Expenses

Reviewing and verifying financial reports, using expense tracking apps or spreadsheets, utilizing a budgeting system, and seeking support and guidance in taking action. Read more to learn about effective expense tracking for your business!

Reviewing and verifying financial reports

It’s crucial to review and verify financial reports regularly, ensuring accuracy and identifying any discrepancies. This process helps in maintaining the integrity of financial records, enabling better decision-making based on reliable data.

By scrutinizing reports for errors or inconsistencies, businesses can mitigate potential risks and uphold transparency in their financial operations.

Staying vigilant with reviewing and verifying financial reports also facilitates compliance with regulatory requirements, enhancing trust from stakeholders such as investors, lenders, or auditors.

Utilizing expense tracking apps or spreadsheets

Utilizing expense tracking apps or spreadsheets is an efficient way to monitor business expenses and maintain financial clarity. It enables real-time tracking of expenses and income, contributing to informed decision-making.

- Accessible Anytime, Anywhere: Expense tracking apps provide the flexibility to record expenses on-the-go, ensuring that no transactions are overlooked or forgotten.

- Automatic Categorization: These tools automatically categorize expenses based on predefined parameters, saving time and minimizing errors in manual data entry.

- Reminder Alerts: Expense tracking apps can send alerts for upcoming payment deadlines or when approaching budget limits, helping in proactive financial management.

- Integration with Bank Accounts: Many apps integrate seamlessly with bank accounts, allowing for automatic import of transactions and reducing the need for manual data entry.

- Customized Reporting: Users can generate customized reports from expense tracking apps, offering a clear overview of expenditure patterns and financial performance.

- Customizable Templates: Spreadsheets can be tailored to specific business needs by creating custom templates to track different types of expenses or income sources.

- Accessibility and Control: With spreadsheets stored on cloud platforms like Google Sheets, multiple team members can access and update them simultaneously while maintaining version control.

- Data Visualization Tools: Spreadsheets offer various visualization tools like charts and graphs to represent financial data visually, aiding in better analysis and decision-making.

Utilizing a budgeting system

By utilizing a budgeting system, you can effectively monitor your business finances in real-time. This proactive approach allows you to allocate funds strategically, identify potential areas of overspending, and make informed decisions based on the financial data.

Implementing a budgeting system also helps track income and expenses, enabling you to stay on top of your financial goals and optimize resources for sustainable growth.

Utilizing a budgeting system streamlines the process of allocating resources while ensuring that every expense aligns with your business objectives. It provides a clear overview of where the money is going, facilitating better decision-making and fostering financial discipline essential for long-term success.

Seeking support and guidance in taking action.

To efficiently track business expenses and earnings, seeking support and guidance is essential. Consider joining online forums or groups focused on small business accounting to connect with others facing similar challenges.

Additionally, reaching out to a financial advisor can provide tailored advice for managing finances effectively. Utilizing these resources will help in gaining valuable insights and perspectives on best practices for tracking income, expenses, and overall financial planning.

Furthermore, exploring mentorship opportunities within your industry can offer personalized guidance from experienced professionals. Engaging with mentors allows for learning from their expertise in budgeting, expense management, and financial reporting.

Conclusion

In conclusion, tracking earnings and expenses is essential for managing your business finances. Keeping organized records and analyzing expenses help identify areas for improvement and maximize tax deductions.

By utilizing accounting software, categorizing expenses, and regularly reviewing financial reports, you can effectively track your income and costs in review writing. Whether through budgeting systems or expense tracking apps, staying proactive in managing your finances is key to success.